Managing money can Backpackers (2022) Full Pinoy Movie Full Movie Onlinebe complicated, and myths are often born from people’s struggles to make it simpler. But simplistic solutions can cost you instead of saving you money.

If you believe any of these five money myths, it’s time to take a closer look at the financial realities.

Certified financial planners typically recommend clients have enough savings to cover expenses for three to six months. If you’re living paycheck to paycheck, though, it can take you years to amass that much.

Say you spend $5,000 each month and somehow manage to trim your expenses by 10%. To accumulate three months’ expenses ($4,500 times three, or $13,500), you would have to put aside every dime of that $500 savings for 27 months. Accumulating a six-month stash could take nearly five years. Either way, it’s too long to put off other important goals, such as saving for retirement and paying off high-interest-rate debt.

A better course: Shoot for a starter emergency fund of $500, which would cover small car repairs or an insurance deductible. Once you’re on track with retirement and debt repayment, you can focus on building up your savings.

Meanwhile, identify other sources of fast cash: items you can sell, nonretirement investments you can tap or low-cost ways to borrow, such as a home equity line of credit.

Many couples don’t pay a marriage penalty — and some get a marriage bonus, meaning their tax burden is lower because they married. That’s particularly true for couples with disparate incomes; together they pay less in tax than they would as singles.

Congress tried to eliminate marriage penalties for most taxpayers by expanding the 10% and 15% federal income tax brackets, which are twice as wide for married couples as for singles. In addition, the standard deduction for married couples is twice that for singles.

The couples most likely to pay a marriage penalty are those at the top and bottom of the income scale. The higher tax brackets aren’t twice as wide for married couples as for singles. At the lower-income end, couples that combine their incomes through marriage could lose some or all of the valuable Earned Income Tax Credit.

Even if you do pay a tax penalty, the cost is likely outweighed by the many other financial and legal benefits marriage provides.

Withdrawals from a Roth IRA are tax-free in retirement, and there are no required minimum distributions, which means you can pass unused money to your heirs, free of income tax. That makes Roths a pretty good deal for wealthier taxpayers and those who expect to be in a higher tax bracket when they withdraw the money than when they contributed it.

Many people, though, will be in a lower tax bracket when they retire. They’d be better off taking a tax break now by making deductible contributions to 401(k)s and regular IRAs.

Of course, no one knows what future tax rates may be. If you want to hedge your bets, you can stash some money in a Roth IRA or Roth 401(k) in addition to making contributions to tax-deductible plans.

You definitely shouldn’t cash out a 401(k) when you leave a job, butrolling over your account into an IRA may not be the best option, either. You may be better off leaving your money in the old plan if it’s a good one, or transferring it to a new employer’s plan if that’s an option.

Financial services firms encourage rollovers because that means you’ll be investing in their retail investment options, which cost more than the institutional funds found in many 401(k)s.

Your 401(k) account has other advantages:

You can withdraw money penalty-free if you leave the company at or after age 55, while IRAs typically make you wait until 59½.

If you continue to work, you can put off withdrawals from your current employer’s 401(k), while IRA withdrawals must start after age 70½.

You can’t borrow money from an IRA for more than 60 days without the withdrawal being taxed and penalized, but most 401(k)s offer loans that can last five years — and sometimes longer for a home purchase.

Workplace plans also are better protected against creditor claims than IRAs if you’re sued or go bankrupt.

If any of these issues might affect you, consider leaving your money in a 401(k).

Scholarships can reduce the amount of financial aid students get, leaving families no better off.

That’s because federal financial aid rules require colleges to ratchet back need-based aid when students win money from “outside” sources such as corporations, nonprofits and fraternal organizations.

Colleges have some leeway in how they implement these rules. The most generous may reduce the amount students are expected to contribute from their own earnings or lower the amount they’ll have to borrow. Other schools that don’t fully meet a student’s financial need will allow scholarship money to fill the gap. Most, however, reduce grant aid dollar for dollar.

Affluent families who don’t qualify for financial aid tend to be the ones who benefit most from scholarships. If you have financial need, though, you’d be smart to ask about a college’s “scholarship displacement” policy before you spend too much time applying for supposedly free money.

Liz Weston is a columnist at NerdWallet, a personal finance website, and author of “Your Credit Score.” Email: [email protected]. Twitter: @lizweston.

SpaceX's BFR has a new name. Elon Musk is calling it Starship.

SpaceX's BFR has a new name. Elon Musk is calling it Starship.

How to see your report history on Instagram

How to see your report history on Instagram

MrBeast has unseated Pewdiepie as the most

MrBeast has unseated Pewdiepie as the most

How to share photos from your iPhone with Airdrop

How to share photos from your iPhone with Airdrop

Best grocery deal: Spend $20 and get $5 off at Amazon

Best grocery deal: Spend $20 and get $5 off at Amazon

Best Apple Watch deal: Get an Apple Watch Series 9 for under $350

Best Apple Watch deal: Get an Apple Watch Series 9 for under $350

Twitter is dead, maybe: The 9 best tweets the week

Twitter is dead, maybe: The 9 best tweets the week

Best deals of the day Nov. 15: Galaxy Buds Live, Fire TV 4

Best deals of the day Nov. 15: Galaxy Buds Live, Fire TV 4

'Black Mirror' Season 7: 'Hotel Reverie,' explained

'Black Mirror' Season 7: 'Hotel Reverie,' explained

Searching for Derek Walcott

Searching for Derek Walcott

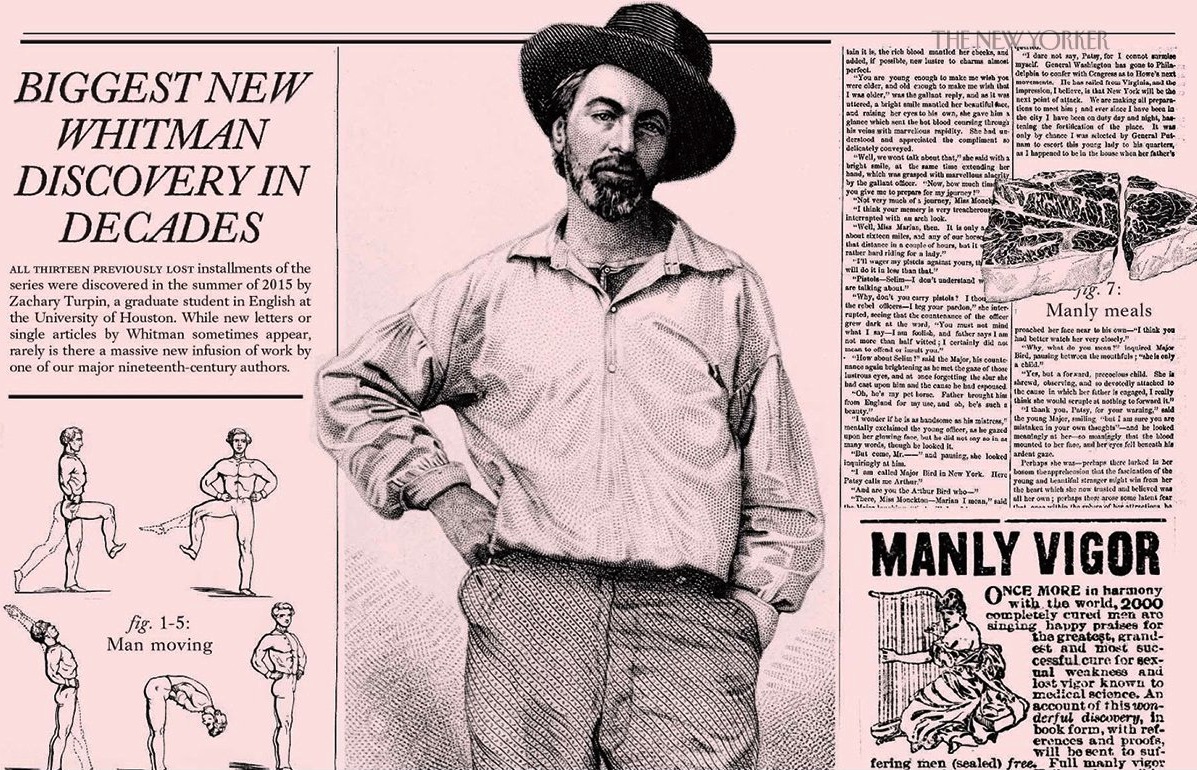

Whitman Says: Quit Smirking and Eat Some Beef Already

Whitman Says: Quit Smirking and Eat Some Beef Already

How to follow and unfollow someone on TikTok

How to follow and unfollow someone on TikTok

Donald Trump will run for president again in 2024, and the internet isn't thrilled

Donald Trump will run for president again in 2024, and the internet isn't thrilled

The FBI almost used the infamous Pegasus hacking tool in criminal investigations: report

The FBI almost used the infamous Pegasus hacking tool in criminal investigations: report

Staff Picks: Taipei Story, Robert Altman, Samantha Hunt, and More

Staff Picks: Taipei Story, Robert Altman, Samantha Hunt, and More

How to access the trickster voice effect on TikTok

How to access the trickster voice effect on TikTok

Amazon Spring Sale 2025: Best Apple AirPods 4 with ANC deal

Amazon Spring Sale 2025: Best Apple AirPods 4 with ANC deal

Staff Picks: Fleur Jaeggy, R. Sikoryak, Brian Blanchfield, and More

Staff Picks: Fleur Jaeggy, R. Sikoryak, Brian Blanchfield, and More

Let's talk about that mysterious baddie in 'Black Widow'Trump's holiday golf game blocked by mystery white truckResident Evil flounders on Netflix in a halfSomeone made Donald Trump the perfect Christmas present and he couldn't be happierTwitter to more patiently explain why you're not worthy of a blue checkBlinking white guy from 'Blinking White Guy' meme speaks out on 'GMA'The new 'Gossip Girl' is too cold to be coolThis Dictionary.com tweet about Pence is the definition of trollingHow to delete your Gmail accountChristmas lightsHow to change your Instagram usernameLewis Hamilton seeks forgiveness after mocking his nephew for wearing a dressFeast your eyes on the 1st photo of Elon Musk's Tesla bound for spaceMan moves furniture so his wife can make snow angels for 29 Instagram followersHow to download YouTube videos on your iPhoneHow to download YouTube videos on your iPhoneLook, your day might resemble a bin fire, but here's a newborn baby white rhinoHow to delete books from KindleStephen Colbert to host Virgin Galactic's livestream launching Richard Branson into spaceYes, everything is hard, but at least your family isn't being circled by a great white shark Agnès Varda's Ecological Conscience How to watch KU vs. K Happy Accidents 30+ Black Friday gaming keyboard deals 2023 COVID XBB.1.5 subvariant: How bad it is, why it's called 'Kraken,' and more Staff Picks: Fat Ladies, Flowers, and Faraway Lands by The Paris Review At the Museum of Anatolian Civilizations Cooking with Ivan Doig Mistaken Self Samuel Beckett's Sitcom Pitches I Read ‘Playboy’ for the Comix McCarthy as Sisyphus: The 11 best tweets about the House Speaker vote debacle The Renaissance Precursor of Rap Battles and Flow iPad (10th gen) deal: $349 at Amazon NYT's The Mini crossword answers for November 17 John H. Johnson and the Black Magazine by Dick Gregory Carrie Mae Weems on Her Favorite Books Viral app Retro Pod removed from Apple's app store 'Please Don't Destroy: The Treasure of Foggy Mountain' review Staff Picks: Pranks, Prints, and Penises

2.1013s , 10133.5859375 kb

Copyright © 2025 Powered by 【Backpackers (2022) Full Pinoy Movie Full Movie Online】,Co-creation Information Network