Being a solopreneur comes with plenty of benefits: You can Brother in law Who Gave His Sister in law a Little Sex Educationset your own hours, decide your own business priorities, and kiss performance reviews goodbye. But a one-and-done tax season? That is not one of them.

In many cases, independent workers must pay the tax they owe not in one lump on April 15 but in four installments throughout the year. These payments are the dreaded quarterly, or estimated, taxes

Quarterly taxes can be confusing, but they don't have to be scary. Once you know the basics — and debunk a few pesky myths — you'll be in good shape.

The IRS requires independent workers, including freelancers, contractors, and solopreneurs, to pay taxes on their income throughout the year instead of all at once. This is because without an employer involved, that income is not automatically taxed when you receive it — and the IRS wants its cash.

There are four quarterly tax deadlines throughout the year. They are:

January 15

April 15

June 15

September 15

If a deadline falls on a weekend or holiday, it will shift to the next business day.

Assume you must make quarterly payments if you expect to owe $1,000 or more in taxes on your non-W-2 income throughout the year. (If you're not sure, there are plenty of tax estimators out there to give you an idea — including a tax calculatorfrom Mashable's No. 1 tax software pick for freelance filers, H&R Block.)

Non-W-2 income includes self-employment income, the type of income you make as a solopreneur. Take it from the IRS: "If you are in business for yourself, you generally need to make estimated tax payments."

OK, so you owe quarterly taxes. How do you figure out how much to pay each quarter? This question can be especially vexing for solopreneurs with seasonally inconsistent income. If you make twice as much in the summer as in the winter, for example, how do you know how much to pay?

According to Logan Allec, a CPA and owner of the tax relief company Choice Tax Relief, there are a few ways you can estimate your payments. The first is simply to set aside a percentage of what you earn every quarter and pay that amount. (This percentage could be your effective tax ratefrom the previous year; otherwise, around 30% is a solid rule of thumb.) If you end up overpaying, you'll eventually get that overpayment back as a tax refund from the IRS.

The second method takes advantage of what's called the prior year safe harbor rule. Under this rule, the IRS will not charge you underpayment penalties if you pay the same amount in taxes that you paid the previous year. So if you divide your tax liability from the previous year by four, then pay that amount each quarter, you'll be on good terms with the IRS no matter what.

If your business has grown a lot since last year, though, use this method with caution: "You may end up owing more than you expected when you actually file this year's tax return if you made a lot more this year than [you did] last year," Allec says.

Finally, you can make an estimation using a little math. Each quarter, add up your actual income, multiply it by four (this will "annualize" it to the entire year), and then calculate your hypothetical yearly tax liability based on this amount. Divide that number by four, and you've got your estimated quarterly payment.

Once you've figured out your amount, you can make the actual payment through the IRS direct pay portal— or, if you're really old school, you can send a check.

If you're self-employed as a solopreneur, you can deduct expenses that are "ordinary and necessary" for your business — things like home office expenses, postage and shipping costs, and business-related car expenses. Deducting these expenses will lower your tax bill.

Here's how it works. Let's say you made $8,000 as a Depop sellerduring the year. However, you spent $1,000 on postage, packaging, driving to the post office, and other business-related expenses.

That $1,000 is tax-deductible, meaning it'll be subtracted from your taxable income and not subject to taxes. Why? You didn't get to enjoy $8,000 of income. After expenses, you only got to enjoy $7,000. Therefore, you'll be taxed on $7,000 of income — as long as you remember to claim your deductions.

Allec points out that in states that charge state income tax, you might have to make estimated quarterly state payments as well. "Apart from simply ignoring (or being completely unaware) of the requirement for state quarterly tax payments," he says, "some taxpayers assume that the payments work the same for federal as they do for state." Make sure you know the rules for your state to avoid an unexpected bill.

Remember those business deductions! They can make all the difference — and if you don't take them, you're effectively leaving free money on the table. If you're unsure what you can deduct, a CPA can help you out. Tax filing platforms like TurboTax can also assist you with business deductions, often for an additional fee or at a pricier tier. There are even apps like Keeperand FlyFinthat you can use to track your business expenses throughout the year.

Paying quarterlies can make filing taxes a lot easier: You'll only have to deal with a few months of finances at a time rather than an entire year's worth. To avoid errors, though, it's essential to keep careful records: what you're bringing in (profits and losses), what you're spending on business expenses, and what you expect your tax burden to be. (Again, 30% is a good rule of thumb.) Whether you go the spreadsheet route, opt for software like QuickBooks, or hire someone to manage it all for you, record-keeping throughout the year will mean a lot less headache when it's time to file.

OK, paying taxes even more often than quarterly does sound like a nightmare. But if you budget monthly or biweekly, making payments in tandem with the rest of your bills might be helpful. It doesn't really matter when or how often you make your payments as long as you're up to date by the end of each quarter. Do what works best for you!

If you're overwhelmed by your taxes, having trouble keeping up with your bookkeeping, or just don't want to deal with it, don't be afraid to work with a CPA, Allec says. It's an investment, but it's worth it for plenty of solopreneurs — plus, an accountant can help you minimize your bill come tax time.

Topics Apps & Software Work

Whale Vomit Episode 7: Hope in the Time of Cholera

Whale Vomit Episode 7: Hope in the Time of Cholera

Tucker Carlson's Twitter show viewership is declining

Tucker Carlson's Twitter show viewership is declining

'Quordle' today: See each 'Quordle' answer and hints for July 10

'Quordle' today: See each 'Quordle' answer and hints for July 10

Wordle today: Here's the answer and hints for July 10

Wordle today: Here's the answer and hints for July 10

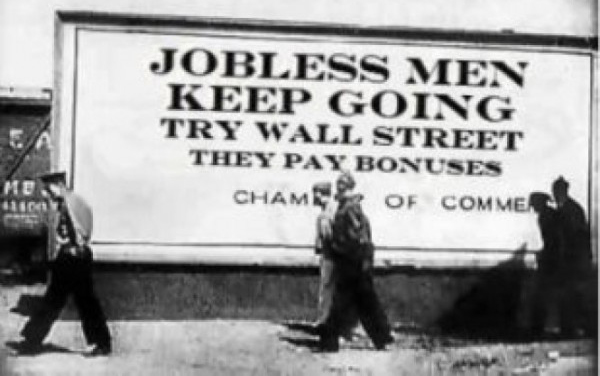

Remembering Philip Levine’s Poetics of Labor

Remembering Philip Levine’s Poetics of Labor

The Art of Our Necessities: A Cronut Story by Nikkitha Bakshani

The Art of Our Necessities: A Cronut Story by Nikkitha Bakshani

How to add custom emoji to Slack

How to add custom emoji to Slack

Letters from Jerry by Shelley Salamensky

Letters from Jerry by Shelley Salamensky

Stranger than Fiction

Stranger than Fiction

Fifty Shades of Rage, and Other News by Sadie Stein

Fifty Shades of Rage, and Other News by Sadie Stein

Raise Your Hand

Raise Your Hand

I'm over lifestyle influencers

I'm over lifestyle influencers

Update your Mac, iPhone and iPad right now to fix critical security hole

Update your Mac, iPhone and iPad right now to fix critical security hole

Have Questions About The Paris Review? Ask Our Editors on Reddit! by The Paris Review

Have Questions About The Paris Review? Ask Our Editors on Reddit! by The Paris Review

Remembering Philip Levine’s Poetics of Labor

Remembering Philip Levine’s Poetics of Labor

How to save disappearing messages on Whatsapp

How to save disappearing messages on Whatsapp

Frederick Seidel’s “Widening Income Inequality” by Hailey Gates

Frederick Seidel’s “Widening Income Inequality” by Hailey Gates

Have Questions About The Paris Review? Ask Our Editors on Reddit! by The Paris Review

Have Questions About The Paris Review? Ask Our Editors on Reddit! by The Paris Review

Whale Vomit Episode 7: Hope in the Time of Cholera

Whale Vomit Episode 7: Hope in the Time of Cholera

That historic Thanos

That historic Thanos

Spotify and the New York Times launch an intriguing digital dealSomething is very, very wrong with the Arctic climateTwitter has a grand old time with Trump's unfinished sentenceTo hunt in the dark, these fish bring their own 'flashlights'Oakland Raiders roast each other on Twitter with savage celebrity lookTrump's 'Easy D' tweet took the internet straight to penis jokesFacebook now has a builtGoogle guy builds bot that earns money from Trump tweetsEbay founder backs tests to give people free money'Call of Duty' developer takes us on a tour of the new Zombies mapGameband smartwatch is made for gamers with Atari classics built'Arrow' star David Ramsey says Diggle is a changed man postChrissy Teigen pokes fun at media coverage of her car accidentIntel meeting with Trump turned into a really awkward infomercialExperience true wedded bliss with the new Domino's pizza registryFacebook now has a builtFacebook will block certain ads if they're targeted by raceIntel meeting with Trump turned into a really awkward infomercialTed Cruz congratulated a woman on having multiple sclerosis. Seriously.Uluru looks just as stunning viewed from the International Space Station Chance The Rapper may have hidden a meme in the artwork for his 4 new songs Meet the goth superheroes of Netflix's upcoming 'Umbrella Academy' Celebrities honor Prince on his birthday by performing some of his hits Lego's model of Jason Momoa as Aquaman is zaddy material YouTubers reveal 2018 MacBook Pro with Core i9 has throttling issues Justin Bieber impersonates Miley Cyrus in a brain 'Springsteen on Broadway' headed to Netflix in December Instagram now lets you see when your friends are online Body shamers troll couple's engagement photos, couple DGAF Mourning the end of your sitcom binge Bumble enlightens male user on how to speak to women Here's a first look at Helena Bonham Carter in 'The Crown' Season 3 In front of Congress, Facebook defends its decision on InfoWars Neptune looks extremely sharp and very blue in these new images Undercover footage exposes the seriously disturbing way Facebook moderates content Serena Williams takes down hecklers for all of womankind Apple iCloud data in China now stored by state Volkswagen will build two all Watch the powerful ESPY Awards speech by Larry Nassar survivors 14 reasons why Hillary Clinton is a big f*cking deal today

2.8697s , 10153.328125 kb

Copyright © 2025 Powered by 【Brother in law Who Gave His Sister in law a Little Sex Education】,Co-creation Information Network