Bitcoin mining consumes a lot of energy. Every once in a while,gay love making sex videos someone compares this to another random metric -- say, the energy consumption of Ireland -- and it induces a collective gasp. How can this thing be sustainable?

Well, it probably isn't. But, long-term, it might not be that big of a deal.

SEE ALSO: Bitcoin's little brother Ethereum is at an all-time highIt's true that Bitcoin mining is an awful energy drain. Hundreds of thousands of application-specific integrated circuits or ASICs -- specific hardware aimed exclusively for mining cryptocurrencies -- hum in huge halls, mainly located in China, and use enormous amounts of electricity to create new bitcoins. They also power the Bitcoin transaction network, but they do it in a horribly inefficient way. The fact that a huge chunk of China's electricity comes from fossil fuels makes the situation even worse.

It just seems so wrong, and on some levels, it is.

But things aren't that simple. We don't know, exactly, how power-hungry Bitcoin really is. And whatever the figure is, Bitcoin certainly doesn't need that much energy to run. Furthermore, energy consumption issues can potentially be fixed with a future upgrade of the Bitcoin software, which is easier than, say, reducing the energy footprint of Ireland. Finally, there are other cryptocurrencies out there working on a solution to this problem.

Despite what you might've read, we don't have exact figures on Bitcoin's energy consumption. A site called Digiconomist keeps stats on how much energy Bitcoin is consuming, and it's the primary source for the stories circulating on the subject. Some of these stats look horrific: Bitcoin's current energy consumption is 30.2 terawatt-hours (TWh), which is more than 63 specific countries, and a single Bitcoin transaction consumes enough energy to power nearly 10 U.S. households for an entire day. But we shouldn't blindly trust those numbers.

Getting exact energy consumption figures for miners, many of whom are secretive and located in China, is not easy, so Digiconomist uses a very roundabout way to make its estimates. The site makes quite a few broad assumptions -- for example, that miners, on average, spend 60% of their revenues on operational costs, and that for every 5 cents spent on those costs 1 kWh of electricity was consumed. It's impossible to say how accurate Digiconomist's index is, but it could be off by some measure.

Furthermore, the energy consumption is rising because of Bitcoin's quite insane price rise, not because the network actually requires it.

Bitcoin's price is at $10,466 at time of writing, up more than 1,000% since the beginning of the year. This price growth is a huge incentive for miners to add even more ASICs and use up even more energy, but it doesn't really have to do much with the number of transactions on the network. In fact, the number of transactions on Bitcoin's network hasn't significantly increased in a year.

Original image has been replaced. Credit: Mashable

Original image has been replaced. Credit: Mashable There are two reasons for this. Bitcoin's network can't handle many more transactions (though a recent software upgrade, yet to take full effect, should improve this). Furthermore, Bitcoin isn't exactly doing its job the way its creator, Satoshi Nakamoto, had intended. Due to its price rise, not many owners actually use their bitcoins to purchase goods; instead, everyone is either hoarding it or speculating with it.

This means that talking about the energy cost of one Bitcoin transaction is misleading. A figure that's thrown around often is the energy cost of one Visa transaction (also a very rough estimate), which is orders of magnitude smaller than that of one Bitcoin transaction. But for Bitcoin, the transactions are not the problem.

In fact, you could theoretically run Bitcoin's entire network on a dozen 10-year old PCs. It wouldn't be very secure from attacks, though, which is another reason why miners are constantly competing for dominance; no one wants to see any one miner control 51% of the network as that would enable them to take over Bitcoin completely.

But it's important to point out that the fact that Bitcoin is currently an enormous energy drain is not due to some irreparable flaw in Bitcoin's protocol. Bitcoin can run more efficiently; it could probably run more efficiently than Visa as it doesn't require offices, staff and other overhead energy costs.

For that to happen, though, something needs to change.

One project Bitcoin could take cues from is Ethereum, the second largest cryptocurrency right now. According to Digiconomist, Ethereum uses roughly three times less energy than Bitcoin; and yet there are twice as much transactions per day on Ethereum's network.

Original image has been replaced. Credit: Mashable

Original image has been replaced. Credit: Mashable And even that could get a lot better in the near future, as Ethereum's development team plans to gradually switch to a completely different mechanism of verifying transactions. Called proof-of-stake, it replaces the current system, called proof-of-work (also used by Bitcoin). Instead of having miners solving complex math calculations, it would reward owning the coins. The concept isn't implemented in Ethereum yet (read here for a detailed explanation) but if it does work as intended, the energy costs, compared to proof-of-work, would be orders of magnitude smaller.

Bitcoin's developers aren't looking to switch to proof-of-stake very soon, but they are working on a solution called Lightning Network that would ideally vastly increase the number of transactions on the network without the need for additional hash power.

So is Bitcoin's lust for energy just a temporary issue that will easily go away? Probably not. Ethereum's leadership has successfully implemented major changes on the network in the past without many problems. Bitcoin, on the other hand, hasn't been able to implement a far more simple upgrade for years, as any upgrade needs a consensus of nearly all users of the network or a (potentially dangerous) hard fork. And Lightning Network, as promising as it is, is just a concept at this stage.

But Bitcoin's problems aren't insurmountable. The solutions are already out there. Sooner or later, Bitcoin will have to adapt.

If it doesn't, in the long run some other cryptocoin will solve it and take its place. Bitcoin has the first-mover advantage, but that quickly wears off when everyone else is leaner, faster, and more efficient than you. And that's perfectly alright; Bitcoin and its energy woes might be forgotten some day, but cryptocurrencies are here to stay.

Disclosure: The author of this text owns, or has recently owned, a number of cryptocurrencies, including BTC and ETH.

Topics Bitcoin

LinkedIn launches ‘Zip,’ a brain

LinkedIn launches ‘Zip,’ a brain

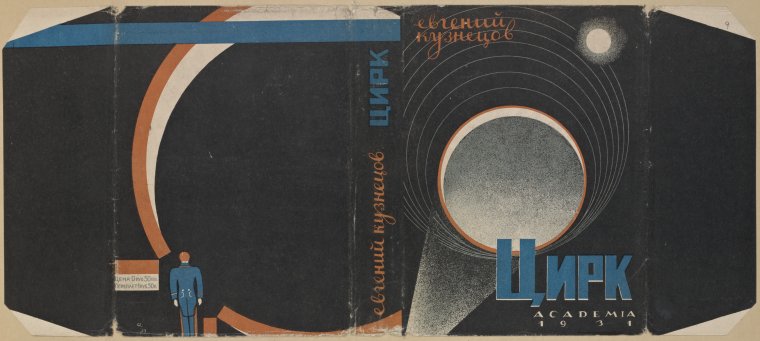

Russian Book Jackets from the 1930s

Russian Book Jackets from the 1930s

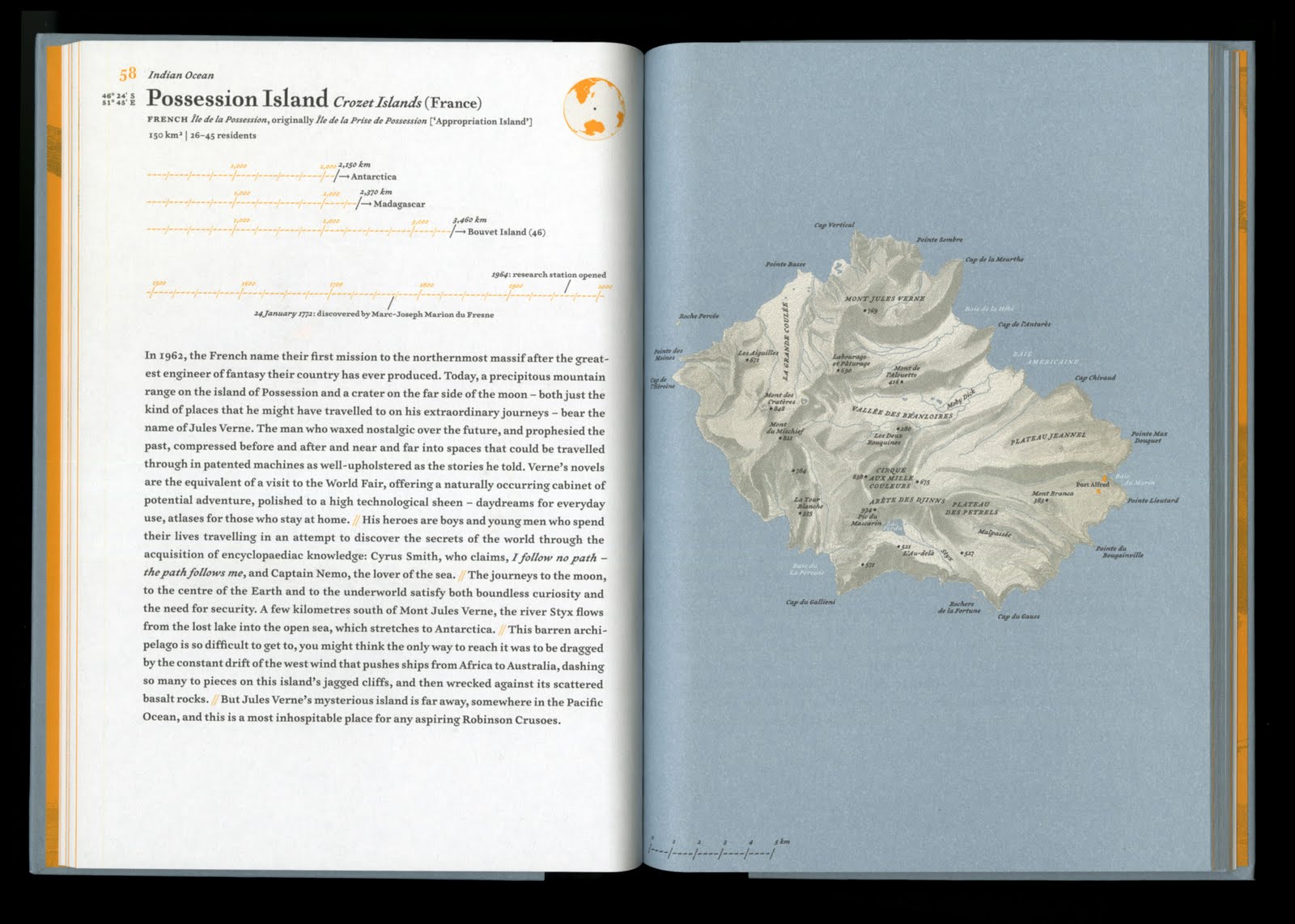

A Pocket Atlas of Remote Islands

A Pocket Atlas of Remote Islands

Prime Day iPad deal: Score an iPad (10th gen) for its lowest price ever

Prime Day iPad deal: Score an iPad (10th gen) for its lowest price ever

The 5 most inappropriate things Donald Trump said at a Puerto Rico disaster briefing

The 5 most inappropriate things Donald Trump said at a Puerto Rico disaster briefing

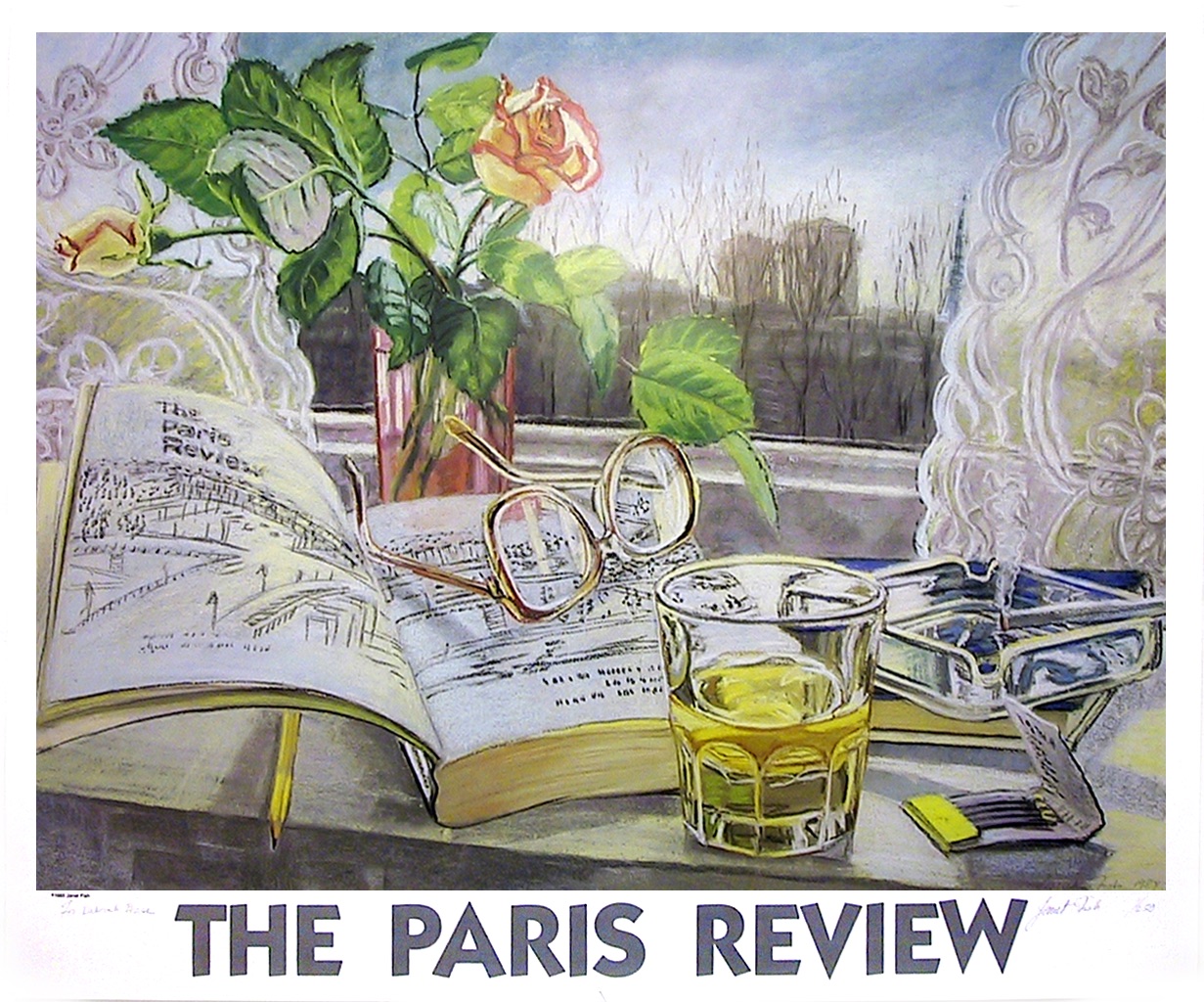

Janet Fish: Glass & Plastic

Janet Fish: Glass & Plastic

When the Used Book Salesman Insults Your Harlequin Romances

When the Used Book Salesman Insults Your Harlequin Romances

Can You Name These Writers? by Stephen Hiltner

Can You Name These Writers? by Stephen Hiltner

Harrison Ford isn't a fan of the Trump administration's climate agenda

Harrison Ford isn't a fan of the Trump administration's climate agenda

Best Apple iPad Prime Day deals: Save on iPad Air, iPad, iPad Pro, and more

Best Apple iPad Prime Day deals: Save on iPad Air, iPad, iPad Pro, and more

Abandon All Hope: Rowan Ricardo Phillips on the 76ers

Abandon All Hope: Rowan Ricardo Phillips on the 76ers

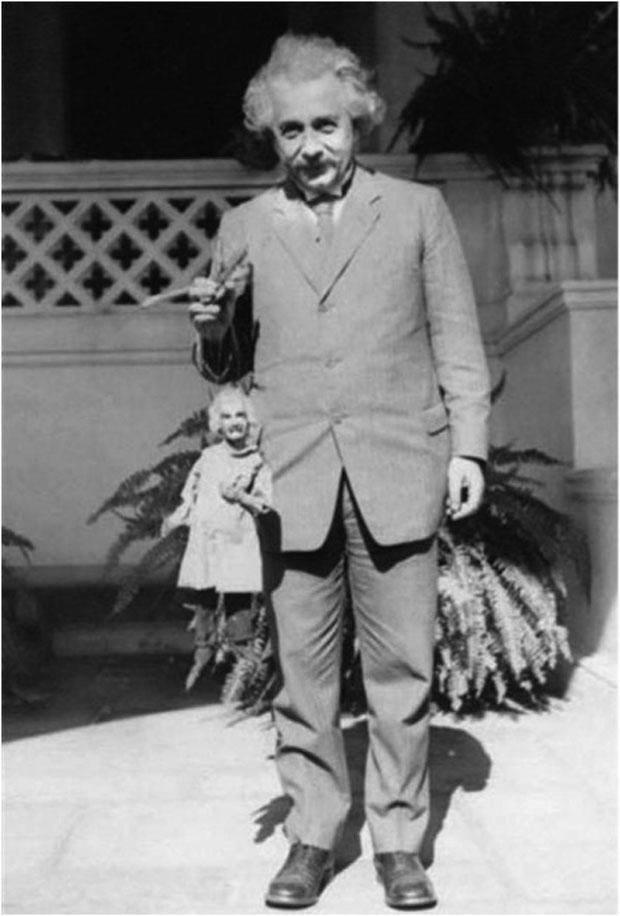

Forman Brown and Albert Einstein’s Marionette

Forman Brown and Albert Einstein’s Marionette

Queen Bitch: Alex Abramovich on David Bowie

Queen Bitch: Alex Abramovich on David Bowie

Best robot vacuum deal: Save $300 on the roborock Qrevo Edge

Best robot vacuum deal: Save $300 on the roborock Qrevo Edge

Lorde's shushgate, explained

Lorde's shushgate, explained

John O’Hara’s “Pal Joey” at 75: Still an Exemplary Novella

John O’Hara’s “Pal Joey” at 75: Still an Exemplary Novella

Calm launches TikTok competition to discover #NextVoiceofCalm

Calm launches TikTok competition to discover #NextVoiceofCalm

Pebble smartwatches are coming, but they won't get along with the iPhone

Pebble smartwatches are coming, but they won't get along with the iPhone

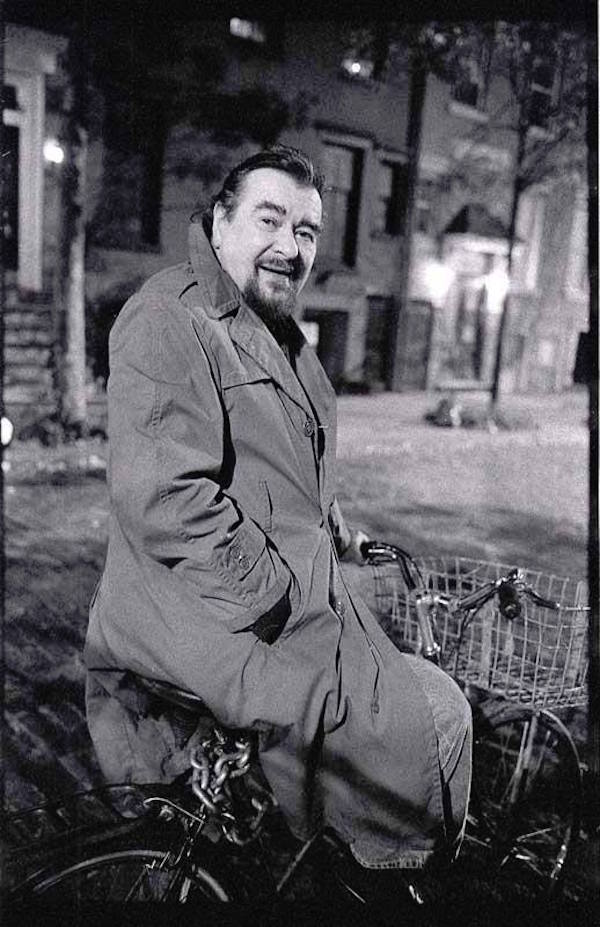

“More Rock and Roll! More Loud!” Giorgio Gomelsky, 1934–2016

“More Rock and Roll! More Loud!” Giorgio Gomelsky, 1934–2016

Sherlock’s Double: At William Gillette’s Castle by Nicolette PolekHow to watch Wisconsin vs. Purdue basketball livestreams: Game time, streaming deals“It’s This Line / Here” : Happy Belated Birthday to James Schuyler by Ben LernerReading the Room: An Interview with Paul Yamazaki by Seminary CoBest Apple AirTag deal: Get 14% off at AmazonWith Melville in Pittsfield by J. D. DanielsIn Warsaw by Elisa GonzalezElon Musk is sending two people to the moon and everyone has FOMOGoogle Maps: It's getting a new generative AI featureIn Warsaw by Elisa GonzalezToo Enjoyable to Be Literature by Helen GarnerGood Manners by Hebe UhartWordle today: The answer and hints for February 3In Warsaw by Elisa GonzalezSpaceX wants to send 2 people around the moon in 2018At Miu Miu, in Paris by Sophie KempMaking of a Poem: Farid Matuk on “Crease” by Farid MatukAfrica's elusive forest elephants are disappearingRipping Ivy by Mary ChildsRecommended Readings for Students by Yu Hua Poets on Couches: Stephanie Burt by Stephanie Burt Fairy Tales and the Bodies of Black Boys by Sabrina Orah Mark Keeping the Fear at Bay by John Freeman Staff Picks: Long Walks, Little Gods, and Lispector by The Paris Review And Alexander Wept by Anthony Madrid Influencers in Islamabad by Sanam Maher Louisville vs. USC livestream: Holiday Bowl kickoff time, streaming deals, and more Mickey Mouse is finally, kind of, becoming public domain Staff Picks: Spines, Spaniels, and Sparsity by The Paris Review A Story in One Picture by The Paris Review How to watch Texas State vs. Rice football livestreams: kickoff time, streaming deals, and more A Poem Is Not a Frontal Assault: An Interview with Jane Hirshfield by Ilya Kaminsky Apple Pay: You can finally use it at this popular home Russia’s Dr. Seuss by Anthony Madrid CES 2024: 3 wild TV trends we're expecting to see Feminize Your Canon: Inès Cagnati by Joanna Scutts 5 rumored tech dropping in 2024 Toys under $20 at Amazon — Dec. 2023 deals Apple Watch import ban timeline: 7 events that got Apple into this mess Poetry Rx: Poems for Social Distancing by Claire Schwartz

1.1526s , 10544.2265625 kb

Copyright © 2025 Powered by 【gay love making sex videos】,Co-creation Information Network